All Categories

Featured

Table of Contents

[/image][=video]

[/video]

Thinking interest rates stay solid, even higher guaranteed rates could be feasible. Using a laddering technique, your annuity profile renews every couple of years to take full advantage of liquidity.

MYGA's are the most preferred and the most usual. With multi-year accounts, the rate is secured for your selected period. Prices are ensured by the insurance provider and will certainly neither raise nor lower over the chosen term. We see interest in short-term annuities providing 2, 3, and 5-year terms.

Protective Life Annuity Phone Number

Which is best, simple interest or compounding interest annuities? The response to that depends upon exactly how you utilize your account. If you don't intend on withdrawing your passion, after that generally uses the greatest rates. Most insurance provider only supply worsening annuity policies. There are, nevertheless, a few policies that debt straightforward interest.

It all depends on the underlying price of the dealt with annuity contract, of course. We can run the numbers and compare them for you. Allow us recognize your intentions with your interest earnings and we'll make ideal recommendations. Seasoned taken care of annuity financiers understand their premiums and rate of interest gains are 100% accessible at the end of their chosen term.

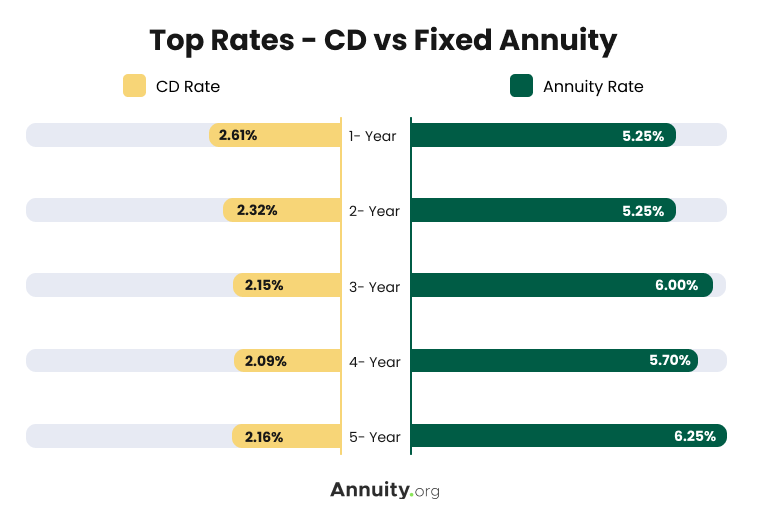

Unlike CDs, fixed annuity policies enable you to withdraw your interest as earnings for as lengthy as you want. And annuities use higher prices of return than mostly all similar financial institution instruments supplied today. The other piece of good information: Annuity prices are the highest possible they've remained in years! We see considerably even more passion in MYGA accounts currently.

There are several highly rated insurance policy companies striving for down payments. There are numerous widely known and highly-rated companies supplying affordable returns. And there are firms specializing in rating annuity insurance coverage companies.

These grades go up or down based upon numerous factors. Luckily, insurer are normally secure and safe and secure establishments. Very few ever fail because they are not permitted to provide your deposits like banks. There are lots of rated at or near A+ providing several of the very best returns. A couple of that you will see above are Dependence Standard Life, sis business Midland and North American Life, Americo, Oxford Life, American National, Royal Neighbors, Pacific Guardian Life, Athene, Sagicor, Global Atlantic, and Aspida among others.

They are safe and reputable plans developed for risk-averse financiers. The financial investment they most carefully appear like is certifications of down payment (CDs) at the bank. See this short video to comprehend the resemblances and distinctions between the two: Our customers purchase dealt with annuities for several factors. Security of principal and guaranteed rate of interest prices are absolutely two of the most important elements.

Compound Interest Annuities

These plans are very flexible. You may wish to delay gains now for bigger payments throughout retirement. We provide items for all scenarios. We assist those needing instant interest earnings currently along with those preparing for future revenue. It is necessary to keep in mind that if you require income currently, annuities work best for those over age 59 1/2.

Why function with us? We are an independent annuity brokerage firm with over 25 years of experience. We are licensed with all carriers so you can go shopping and compare them in one area. Prices are moving quickly and we don't recognize what's on the horizon. We aid our customers secure in the highest possible yields possible with safe and safe insurance provider.

In current years, a wave of retiring child boomers and high passion prices have actually helped fuel record-breaking sales in the annuity market. From 2022 to 2024, annuity sales topped $1.1 trillion, according to Limra, a worldwide research organization for the insurance coverage sector. In 2023 alone, annuity sales raised 23 percent over the prior year.

Allianz Abc Annuity

With more possible rate of interest price cuts coming up, uncomplicated fixed annuities which tend to be much less challenging than various other choices on the marketplace might become much less appealing to consumers due to their waning prices. In their area, other selections, such as index-linked annuities, may see a bump as customers look for to catch market growth.

These rate walks provided insurer space to provide more attractive terms on repaired and fixed-index annuities. "Rate of interest on taken care of annuities additionally climbed, making them an eye-catching financial investment," says Hodgens. Also after the stock exchange recoiled, netting a 24 percent gain in 2023, remaining concerns of an economic downturn maintained annuities in the spotlight.

Various other variables likewise added to the annuity sales boom, including even more financial institutions now providing the products, states Sheryl J. Moore, CEO of Wink Inc., an insurance marketing research company. "Customers are becoming aware of annuities more than they would've in the past," she states. It's likewise much easier to buy an annuity than it used to be.

"Actually, you can request an annuity with your representative through an iPad and the annuity is authorized after finishing an on-line type," Moore states. "It made use of to take weeks to get an annuity with the problem process." Fixed annuities have thrust the current development in the annuity market, representing over 40 percent of sales in 2023.

But Limra is expecting a draw back in the appeal of dealt with annuities in 2025. Sales of fixed-rate deferred annuities are anticipated to drop 15 percent to 25 percent as passion rates decline. Still, dealt with annuities have not shed their shimmer quite yet and are using traditional financiers an attractive return of more than 5 percent in the meantime.

Annuities Example Problems

There's also no requirement for sub-accounts or profile monitoring. What you see (the assured price) is what you get. Variable annuities often come with a washing listing of fees death expenses, management costs and financial investment management charges, to call a few. Set annuities keep it lean, making them a simpler, cheaper choice.

Annuities are complicated and a bit different from other monetary items. (FIAs) broke sales documents for the 3rd year in a row in 2024. Sales have virtually doubled since 2021, according to Limra.

Nevertheless, caps can differ based upon the insurance firm, and aren't most likely to remain high for life. "As rates of interest have actually been boiling down recently and are expected to come down even more in 2025, we would certainly anticipate the cap or involvement prices to also boil down," Hodgens claims. Hodgens anticipates FIAs will certainly remain appealing in 2025, however if you remain in the market for a fixed-index annuity, there are a few things to keep an eye out for.

So theoretically, these crossbreed indices aim to smooth out the low and high of a volatile market, yet in truth, they have actually usually failed for customers. "Many of these indices have actually returned little to nothing over the past couple of years," Moore states. That's a difficult pill to ingest, thinking about the S&P 500 uploaded gains of 24 percent in 2023 and 23 percent in 2024.

The even more you research and look around, the more probable you are to find a reputable insurer happy to provide you a respectable price. Variable annuities as soon as controlled the marketplace, however that's altered in a large means. These products experienced their worst sales on record in 2023, going down 17 percent contrasted to 2022, according to Limra.

National Integrity Annuity

Unlike taken care of annuities, which offer disadvantage defense, or FIAs, which stabilize security with some development potential, variable annuities offer little to no security from market loss unless cyclists are added on at an included price. For capitalists whose top priority is maintaining resources, variable annuities merely don't gauge up. These items are also infamously intricate with a background of high charges and hefty surrender fees.

When the market fell down, these motorcyclists ended up being responsibilities for insurance firms due to the fact that their assured values went beyond the annuity account values. "So insurance provider repriced their motorcyclists to have less attractive functions for a greater price," claims Moore. While the sector has actually made some efforts to enhance transparency and minimize prices, the product's past has actually soured lots of consumers and economic consultants, who still check out variable annuities with apprehension.

Equitable Accumulator Annuity

Yet, RILAs supply consumers much greater caps than fixed-index annuities. Just how can insurance provider afford to do this? Insurers earn money in other methods off RILAs, typically by paying financiers much less than what they earn on their financial investments, according to an evaluation by the SEC. While RILAs seem like a lot what's not to like about higher possible returns with less fees? it is very important to understand what you're registering for if you remain in the market this year.

For instance, the wide variety of attributing techniques utilized by RILAs can make it challenging to contrast one item to another. Greater caps on returns additionally feature a compromise: You take on some threat of loss beyond an established flooring or barrier. This barrier shields your account from the very first portion of losses, typically 10 to 20 percent, yet after that, you'll lose money.

Table of Contents

Latest Posts

Transamerica Fixed Annuity

Symetra Annuity Withdrawal Form

Amerus Annuity Group Co

More

Latest Posts

Transamerica Fixed Annuity

Symetra Annuity Withdrawal Form

Amerus Annuity Group Co